Impact of Risk Adjustment Operations on ACA Marketplace Growth

Let’s have a conversation

The Affordable Care Act (ACA) revolutionized healthcare in the United States by prohibiting insurers from denying coverage or charging higher premiums based on pre-existing conditions, leading to an increase in health insurance coverage amongst United States residents. A key process that was introduced with the creation of State ACA Marketplaces was the implementation of a Risk Adjustment transfer payment model. Each year, Department of Health and Human Services (HHS) completes a risk adjustment calculation which redistributes a percentage of premium revenue from ACA insurers with lower risk scores to ACA insurers with higher risk scores within their respective state markets. Failure to capture an accurate and complete risk score exposes an ACA insurer to the risk of understating the health risk of the population. Understating member health risk will lead to redistributing premium revenue needed for member care, causing an operational budget shortfall. A large value fund transfer may indicate a Health Information Oversight System (HIOS) contract was unable to capture an accurate and complete risk score for its population and signal financial headwinds entering the next benefit year.

ACA enrollment continues to grow as seen by the surge in 2024 numbers increasing to 21.3 million people, up from 16.4 million people in 2023 (Jared Ortaliza, 2024). The recent increase in enrollment signals a potential increase in ACA Marketplace insurers. Insurer participation in the ACA Marketplace has been variable since the start in 2014. (McDermott & Cox, 2020) The highest level of participation was in 2015, at an average of 6 insurers per state (ranging from 1 insurer in West Virginia and New Hampshire to 16 insurers in New York). Insurer participation declined after 2015 to 4.3 insurers per state in 2018 with the change being attributed to insurance company losses. The process of launching a product is complex from the initial application and benefit design through to operations. Insurers entering the market may face financial headwinds within the first few years unless the appropriate strategies and operations are deployed. Risk adjustment might contribute to financial headwinds if not appropriately planned and executed during the preparation and operations of the first year.

ACA Marketplace participation has been increasing since 2018, reaching 5 insurers per state in 2021. As the market approaches the high-water mark set in 2015, one might wonder if a market contraction is coming. ProspHire was interested to understand if risk adjustment outcomes are a contributor to new HIOS contract financial performance. ProspHire conducted a simple analysis by comparing the HHS Summary Report on Permanent Risk Adjustment Transfers for the 2022 and 2021 benefit years to answer two questions:

- Was there an increase in new HIOS contracts and new insurers from 2021 to 2022?

- How did the new HIOS contracts and new insurers fare in their first year of operations?

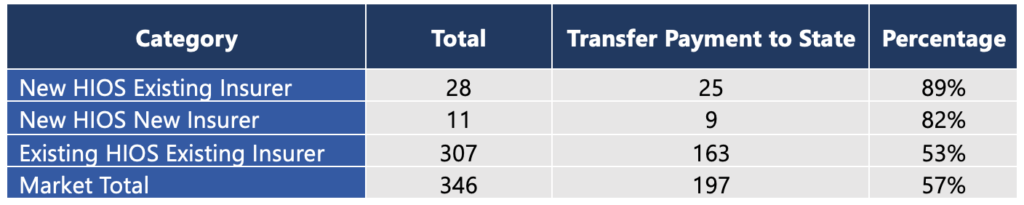

In 2022, there were 346 non-catastrophic individual ACA Market HIOS contracts compared to 294 in 2021, indicating a net growth of 17% (346/294). Of the 346 plans, 39 were new HIOS contracts in 2022 of which 11 were HIOS contracts given to new insurers (Table 1). New HIOS contracts were more likely to have a risk adjustment transfer payment to the state. Of new HIOS contracts, 82% (9/11) of new insurers and 89% (25/28) of existing insurers completed transfer payments to the stat compared to the national market rate of 57% (197/346).

Table 1: Frequency of Transfer Payments to the State in 2022 by New versus Existing Status

This simple analysis indicates new HIOS contracts entering the ACA Marketplace are more vulnerable than the existing HIOS contracts to completing transfer payments back to the state at the end of the year for risk adjustment. Past history as an ACA insurer does not seem sufficient to avoid a yearend transfer payment to the state. This analysis indicated that new and existing insurers with new HIOS contracts had similar likelihood for risk adjustment transfer payments. Insurers preparing to enter the ACA Marketplace with a new HIOS contract should consider two items. First, the revenue return is a cash transfer from the ACA insurer to the state and it cannot be avoided, even if the ACA insurer elects not to participate in the subsequent year. Second, many operational pieces must be implemented in quick succession to improve the opportunities to capture an accurate and complete risk score in the first year of operations:

- Prospective programs to increase provider and member engagement in completion of comprehensive examinations.

- Encounter submission platform implementation and calibration with a corresponding error correction management workflow.

- Retrospective program chart retrieval targeting, chart retrieval vendor selection and implementation, and a highly accurate chart review vendor.

- Risk Adjustment Diagnosis Validation (HHS-RADV) vendor selection and management process.

Whether an Insurer is already established in the ACA Marketplace, or looking to join for the first time, a thoughtful risk adjustment strategy is just one piece of the puzzle to ensure success. ProspHire is uniquely positioned to support your organization through the QHP application process, operational readiness, vendor implementation and strategy advisory. Connect with us to learn more.

ProspHire

216 Blvd of the Allies, Sixth Floor

Pittsburgh, PA 15222

412.391.1100

prosper@prosphire.com

© 2025 ProspHire, LLC. All Rights Reserved / Terms of Use / Privacy Policy