SY2024 Data Insights

The Centers for Medicare & Medicaid Services (CMS) released the 2024 Star Ratings for Medicare Advantage plans on October 13th, 2023.

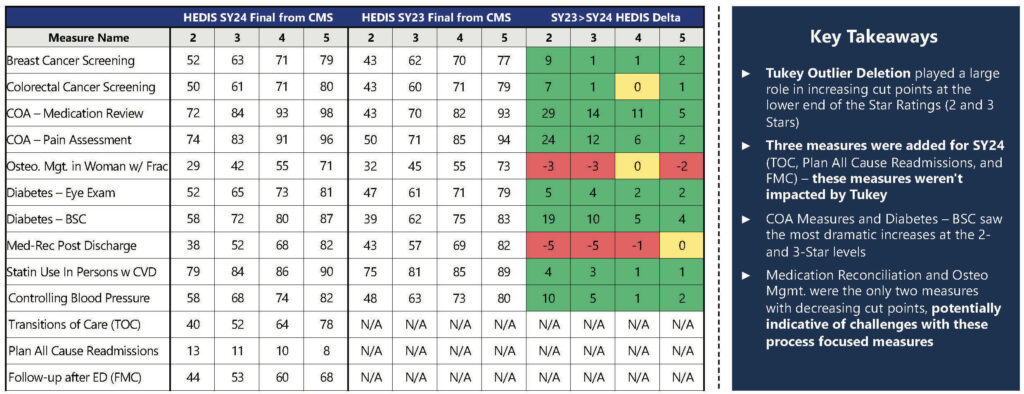

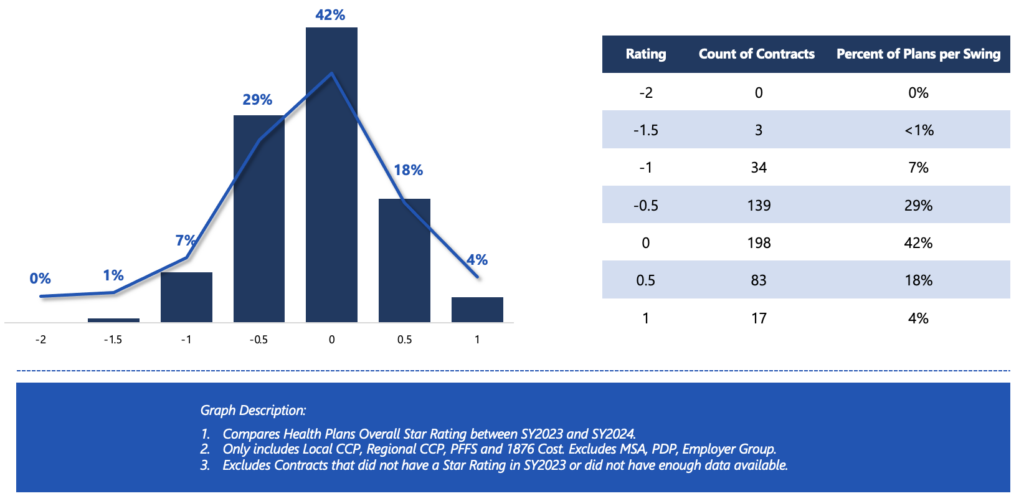

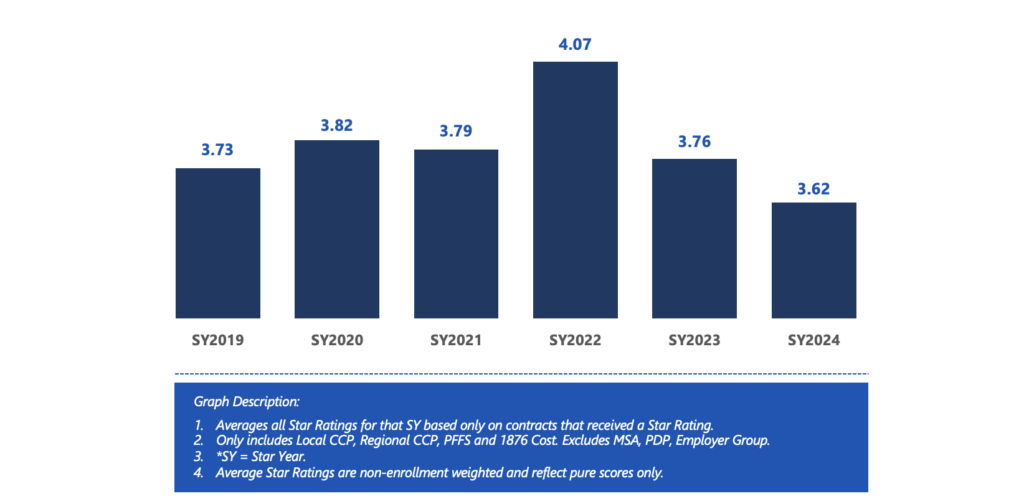

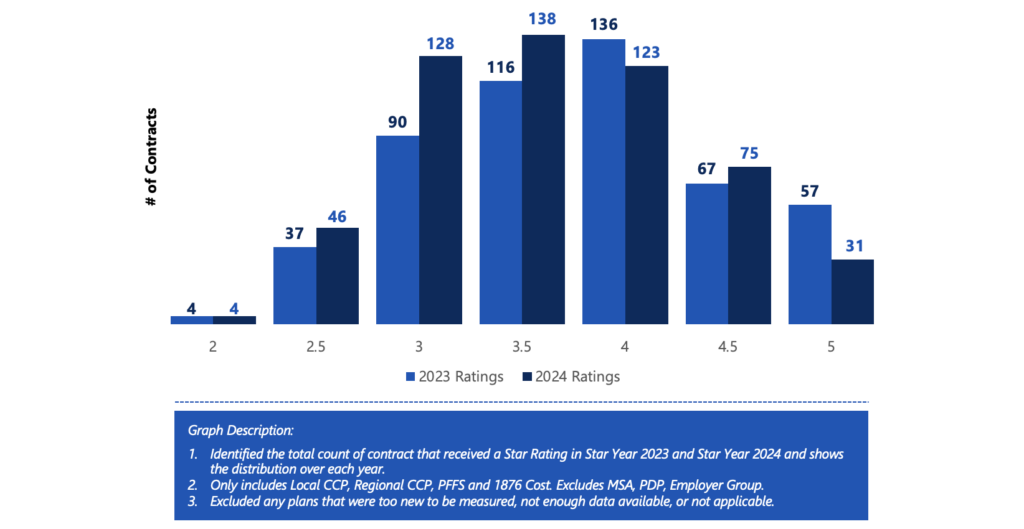

The 2024 Star Ratings incorporated several changes to the methodology, including the introduction of the cut point modifying statistical technique – Tukey outlier deletion. The realized outcomes of Tukey were just as significant as expected. The MAPD average dropped from the 2023 level of 3.76 to 3.62 in 2024, making this the lowest performance within the last six Star Years. Of the plans that received a star rating in 2023, 64% of health plans saw a decrease in rating in Star Year 2024.

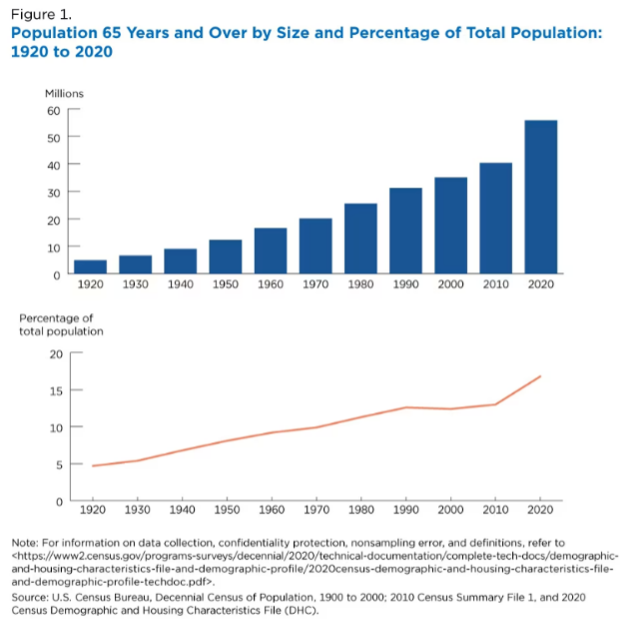

The ratings also showed that 42% of MAPD plans earned an overall rating of 4 stars or higher for Star Year 2024, down slightly from 51% in Star Year 2023. However, when weighted by enrollment, 74% of MAPD enrollees are currently in 4+ star plans for Star Year 2024 which is in line with industry trends.

Thirty-one MAPD contracts earned 5 stars, marking them as highest quality “high performing” plans. CMS highlighted these plans on the Medicare Plan Finder website to help beneficiaries identify top-rated options.

A further breakdown of the data shows that performance varies significantly by profit vs non-profit plans. Non-profit MAPDs plans were almost twice as likely to receive 4+ Stars compared to those for-profit plans (~56% vs. ~36%). Also, in line with industry trends, the MAPD plans with longer tenure also scored higher relative to newer plans.

Our team put together Phase 1 of our SY2024 Insights and Analysis to begin to “tell the story” for SY2024.

Rating Swing Distribution from Prior Year1

Average Star Rating Year Over Year1

Distribution of Star Rating SY2023 and SY20241

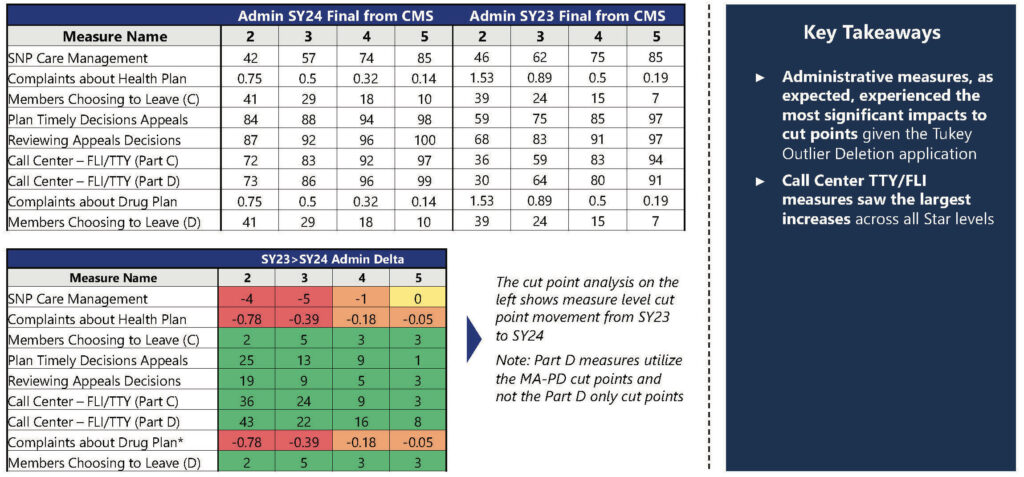

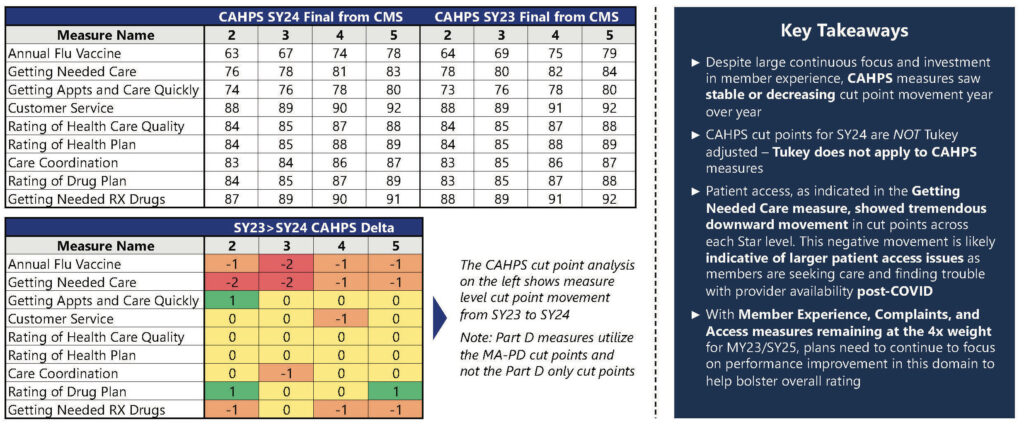

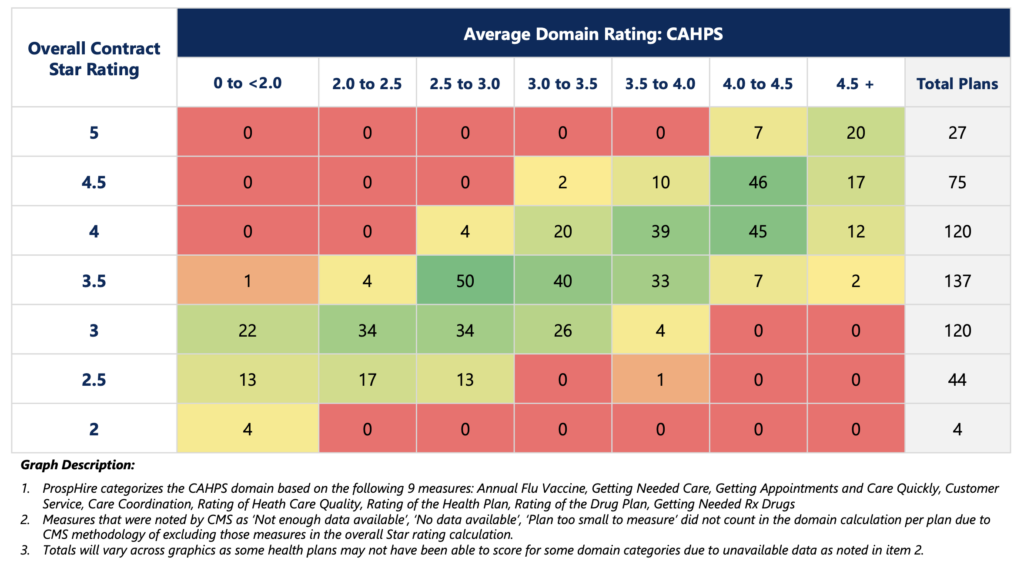

In SY2024, CMS continued the emphasis on Member experience by continuing to utilize the 4x weighted for the Consumer Assessment of Healthcare Providers and Systems (CAHPS) survey measures and health plan operations measures.

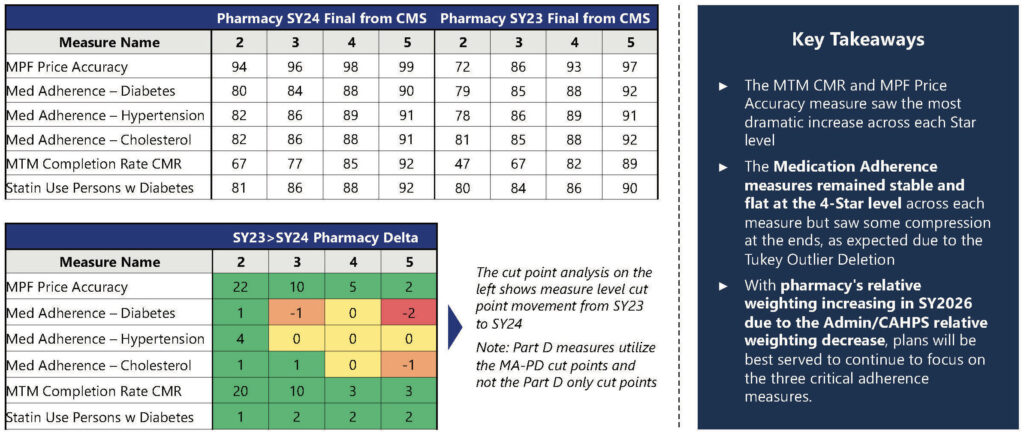

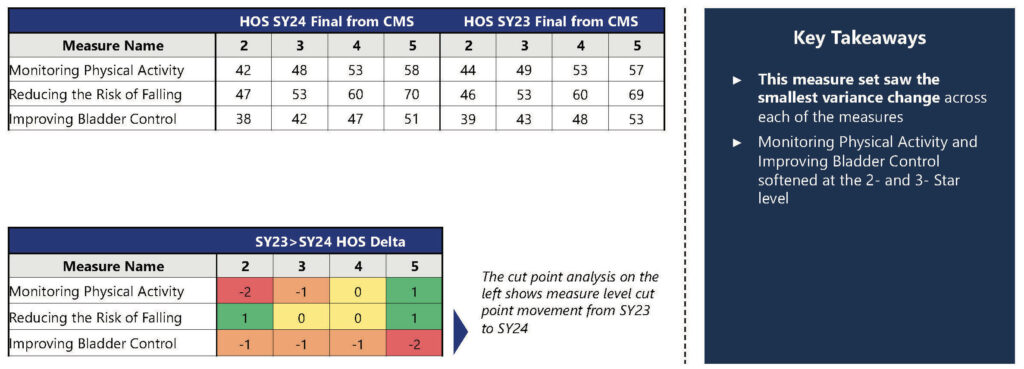

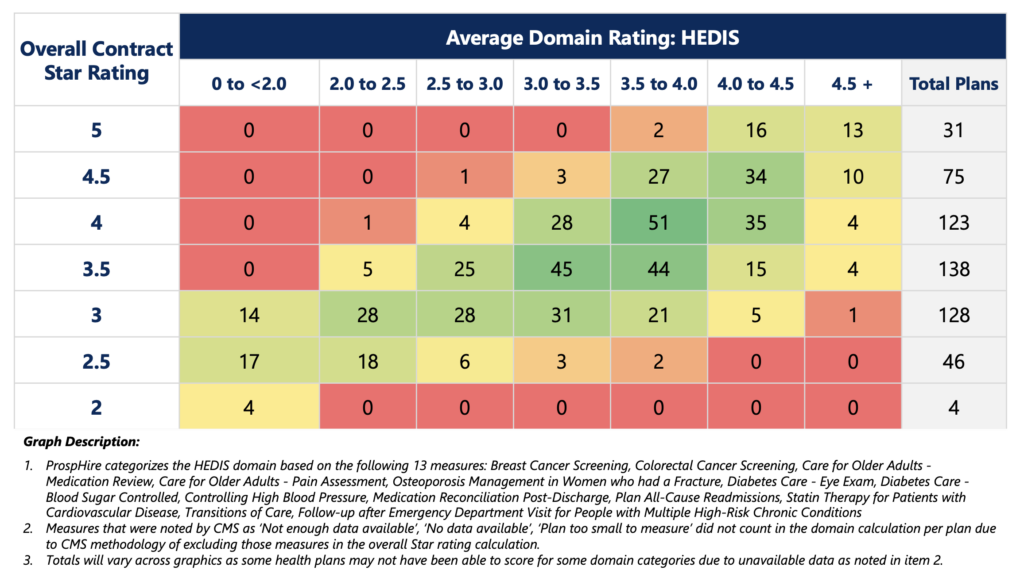

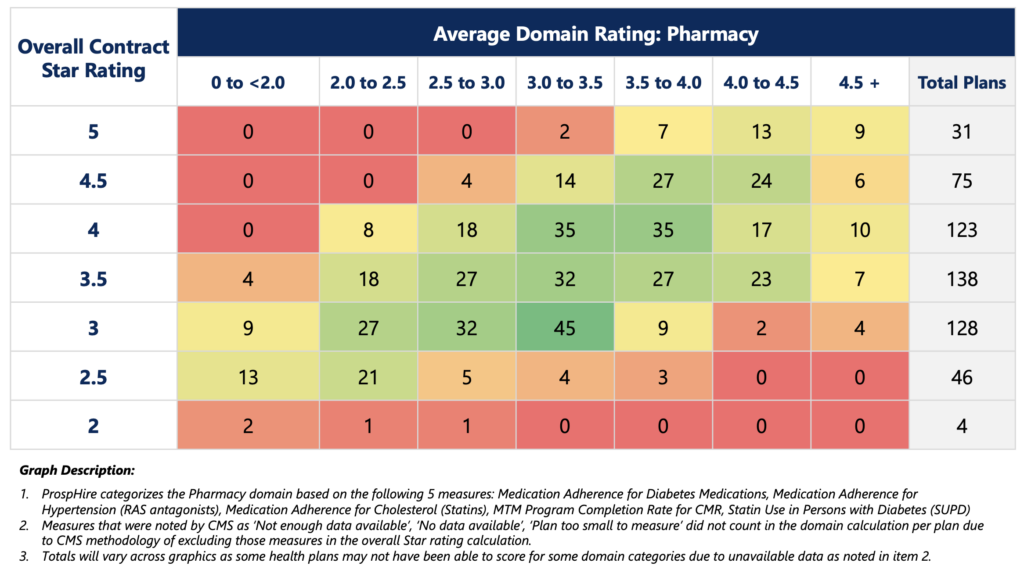

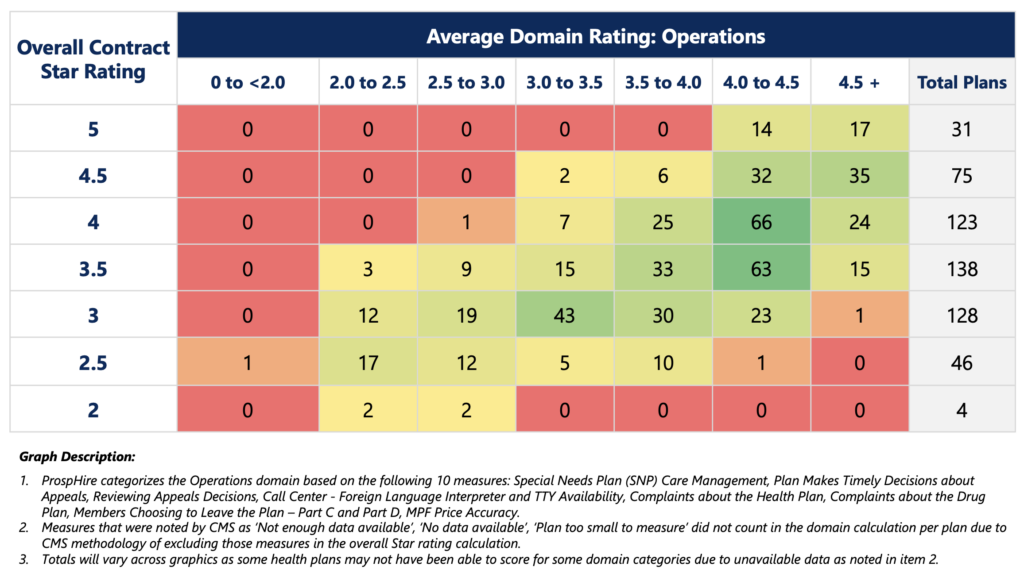

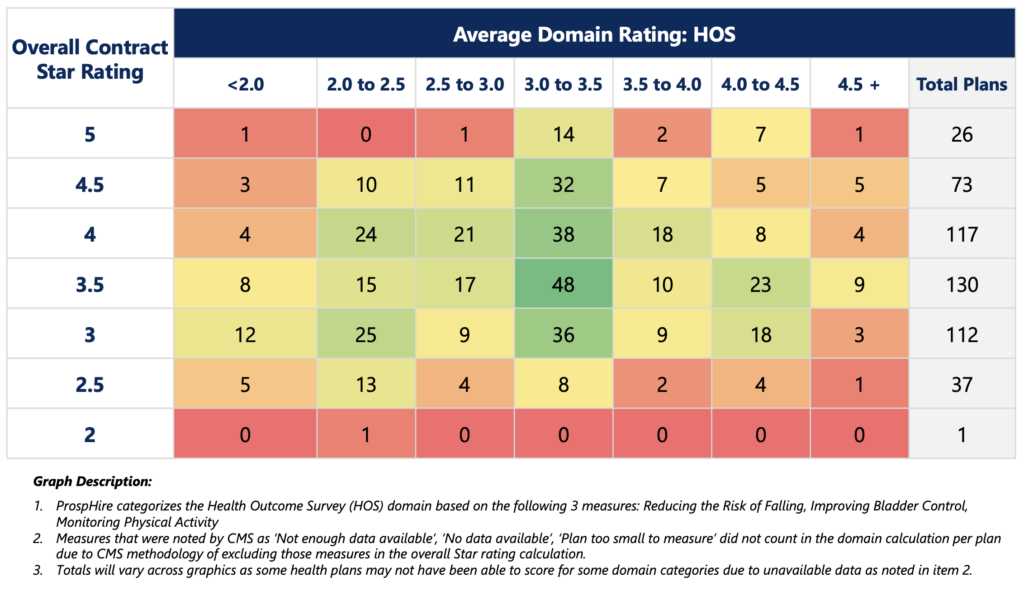

Using the data presented in the tables below, our team conducted an analysis on the distribution of overall plan ratings in correlation with a plan’s performance in five domains. We aggregated performance measures within each domain to create a comprehensive domain score. This assessment allowed us to gain insights into what aspects health plans prioritize to achieve high performance in the 4- to 5-star range, considering health plan performance in CAHPS, HEDIS, Pharmacy, Operations, and HOS.

Key Highlights:

- The Operations domain demonstrated a more concentrated performance range for high-performing plans, with 82% of 4.0+ star plans achieving a score of 4.0 or higher in the designated measures.

- In order to achieve 4.0+ Stars, plans were required to succeed in CAHPS. Of the 147 plans that received a 4.0+ star, 88% of them had a minimum CAHPS scoring average of 3.5 stars.

- In line with CMS methodology weighting, HEDIS, Pharmacy, and HOS showed a more expected spread in overall health plan performance based on the domain’s average rating.

In summary, the health plan operations domain stands out as a consistent and influential factor driving higher Star ratings for health plans. Thus, it should remain a focal point for health plans aiming to achieve a 4- to 5-star overall rating. Additionally, while CAHPS carries significant weight, strong performance in other domain areas can compensate for subpar survey results, specifically HEDIS being a large driver.

As we enter the final stretch of the performance year SY2025, it is essential to place significant emphasis on the efforts of Q4. Health plans should arrange all available resources and make every effort, giving special attention to driving improvements in HEDIS performance. This Q4 push can act as an additional safeguard prior to the CAHPS survey distribution in March 2024.

Looking forward to the arrival of CY2024 (SY2026), health plans must be attentive to an upcoming CMS methodology adjustment. Starting from the performance year 2024, CMS will assign similar weight to CAHPS, Operations, HEDIS and Pharmacy measures (CAHPS and Operations measures shifting from 4x weight to 2x weight). This signifies a shift away from over-reliance on member experience as primary performance drivers. Instead, it requires a strategic approach to enhance performance across all areas.

Plan Count by Overall Rating & Average CAHPS Rating1,2,3

Plan Count by Overall Rating & Average HEDIS Rating1,2,3

Plan Count by Overall Rating & Average Pharmacy Rating1,2,3

Plan Count by Overall Rating & Average Operations Rating1,2,3

Plan Count by Overall Rating & Average HOS Rating1,2,3

If you have any questions or are curious to speak about your plans Star Rating and how we can help improve, submit the form on the right.