HEDIS Opioid Measures and Strategies to Mitigate the Use of Opioids

Let’s have a conversation

As the COVID-19 pandemic wanes through the public health lens, attention is shifting towards America’s pre-pandemic epidemic: opioid misuse. In 2017, the US Department of Health and Human Services declared the opioid crisis a national emergency. The CDC has stated that the opioid crisis began in the late 1990s, but an increasing number of individuals affected by addiction and opioid use disorder deaths over the last decade has increased public awareness of the topic.

Opioid addiction often begins with a prescriber trying to help a patient manage pain. Patients can receive excessive amounts of opioid-containing pain medications, leading to addiction and unlawful obtainment and use of medications within this class. It is estimated that tens of thousands of Americans die every year due to opioid misuse. With this, HEDIS (Healthcare Effectiveness Data and Information Set), managed by the National Committee for Quality Assurance (NCQA), has set forth three measures specific to mitigating overprescribing, misuse, and overuse of opioids. Here, we will highlight the opioid specific HEDIS measures, along with strategies and best practices for plans to consider.

As defined by HEDIS, the opioid measures include:

- Use of Opioids at High Dose (HDO) – Members 18 years of age and older who received prescription opioids at a high dosage (average morphine milligram equivalent dose [MME] ≥90) for ≥15 days during the measurement year.

- Use of Opioids from Multiple Providers, Prescribers and Pharmacies (UOP) – Members 18 years of age and older receiving prescription opioids for ≥15 days during the measurement year from multiple providers. Three rates are reported:

- Multiple Prescribers: The proportion of members receiving prescriptions for opioids from 4 or more different prescribers during the measurement year.

- Multiple Pharmacies: The proportion of members receiving prescriptions for opioids from 4 or more different pharmacies during the measurement year.

- Multiple Prescribers and Multiple Pharmacies: The proportion of members receiving prescriptions for opioids from 4 or more different prescribers and 4 or more different pharmacies during the measurement year.

- Risk of Continued Opioid Use (COU) – Members 18 years of age and older who have a new episode of opioid use that puts them at risk for continued opioid use. Two rates are reported:

- The percentage of members with at least 15 days of prescription opioids in a 30-day period.

- The percentage of members with at least 31 days of prescription opioids in a 62-day period.

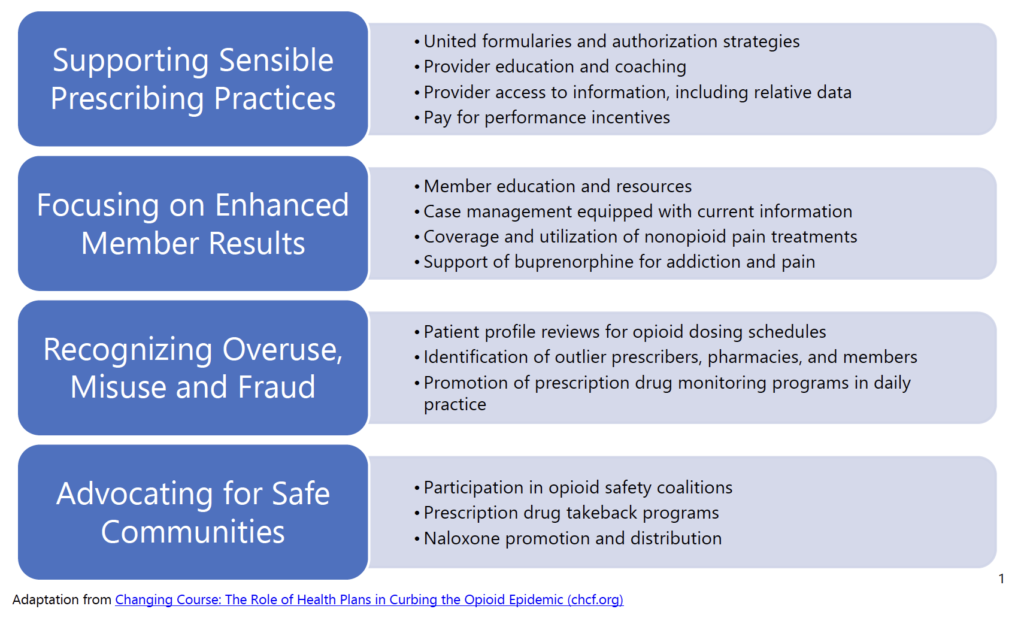

What Can Health Plans and Providers Do To Improve Opioid Overuse?

These three HEDIS measures create opportunities for providers and plans to control opioid utilization and identify members who are/or at risk of becoming opioid dependent. Without careful implementation and maintenance of these measures, members may face an unhindered path to becoming addicted, suffering opioid-related disorders and potential overdose deaths. Outlined below1 is a list of best practices and strategies health plans and providers can take to mitigate the risks and negative consequences of uncontrolled opioid use.

Supporting Sensible Prescribing Practices: Health plans can support the appropriate prescribing of opioids by aligning their formulary structure and opioid monitoring system. Members should be monitored when initiating opioid treatment or maintained on chronic therapy. Initial prescriptions for opioids exceeding 50 MME per day should automatically flag for health plan pharmacist review. Rationale for use should be provided by the prescriber and documented in the member’s medical record regarding duration of therapy and indication for use.

Focusing on Enhanced Member Results: Promoting enhanced member results should place an emphasis on the utilization of nonopioid pain treatment regimens. Simplistic changes can consist of monitoring patients on over-the-counter (OTC) pain medications, such as acetaminophen or ibuprofen, before beginning opioid therapy. Health plans should also consider triaging patients to appropriate alternative therapy, such as chiropractic care or physical therapy. Treating the source of the pain instead of promoting medication use may prove beneficial to some members.

Recognizing Overuse, Misuse and Fraud: To identify issues with opioid prescribing or member consumption, health plans can consider incorporating prescription drug monitoring programs into daily practice. Providers and pharmacists alike should review the local state prescription drug monitoring program prior to writing a prescription for opiate therapy or dispensing the medication to the patient. These programs have decreased the number of multiple providers writing opioid prescriptions for members and decreased substance abuse admissions. Dispensing profiles can help identify the validity of prescriptions for members or duplicative therapy that can impact the member’s overall health.

Advocating for Safe Communities: Participating in activities, such as prescription drug takeback programs, can help to keep members of the community safe. Health plans should consider utilizing local agencies to sponsor these takeback programs. Unnecessary prescription drugs, including opioids, can be misused or abused by individuals prescribed the medications or unregulated members of the community. Increased prevalence of these programs in the community is the best way to dispose of used or expired medications.

Don’t Wait to Provide the Highest Quality Possible for your Members

At ProspHire, we want to help you provide the highest quality of care possible for your members. With our team’s extensive healthcare industry knowledge and commitment to delivering valuable results, we are here to help you optimize strategy and execution of care.

Aligning best practices with strategy can assist plans in reducing the inappropriate use of opioids. From providing current state assessments to implementation playbooks, our experienced staff can help health plans develop an improvement pathway that is tailored to meet the needs of your organization.

ProspHire’s team of clinical experts are ready to partner with your health plan and work shoulder to shoulder to improve member and community safety. Connect with us today.