Expanding AI in the Health Insurance Customer Experience

Let’s have a conversation

Recently, the Centers for Medicare & Medicaid Services have changed the final calculation to increase the weight of customer experience measures. By 2023, the influence of customer experience metrics will increase to 57% of the final score.1 High performance on customer experience metrics is a significant challenge among health plans, when as recently as 2018, a Net Promoter Score (NPS) score comparison revealed that the health insurance industry had a 19 percent lower score than every other sector except utilities.2

The inability of health insurers to positively impact customer experience leaves them vulnerable to lost revenue and increased customer acquisition costs. More specifically, insurers participating in the Medicare Advantage Stars program compete for $15 billion in additional incentives for those members.2 A significant portion of this Star rating and subsequent reimbursement utilizes customer experience measures, including the CAHPS survey. The need for new, innovative and data-driven solutions in this facet of health insurance is required for insurers to make intentional gains in their customer experience ratings, thereby preventing financial losses due to low retention rates and Star ratings.

At ProspHire, we believe that health plans have the opportunity to improve customer experience through the use of artificial intelligence (AI) and other data-driven approaches. The application of AI in healthcare has dramatically increased in recent years. Forecasts by Business Insider project healthcare spending on AI will grow at an annualized rate of 48% between 2017 and 2023.3 Presently, AI benefits are typically associated with claims processing and fraud prevention, with figures of $122 billion in savings due to automatic claims processing realized in 20204 and a reduction of $527 million in losses due to fraud in 20165. While these areas are driving healthcare forward, how does the healthcare system utilize AI to assist patients with navigating, understanding and utilizing their health insurance benefits, thereby ensuring a positive customer experience with their plan and respective insurance provider?

Personalized Outreach and Product Recommendations for Improved Retention

“People are very careful about how they allocate limited attention and cognitive resources. Particularly when resources are scarce, people tend to have tunnel vision that focuses limited attentional resources to only the most pressing matters. People have less cognitive bandwidth for making decisions or taking action on matters with distant outcomes.”

Lisa Zaval, PhD

Limetree Behavioral Science

Advisor

One method to improve retention in the health insurance space is to increase relevant engagement with members, specifically those deemed high retention risk. Retail sectors have extended the application of AI to improve customer experiences through personalized marketing and product recommendations to specific groups of customers based upon past purchase history. MA members prefer personalization, with 86% of respondents to an online Harris Poll requesting more personalization to their communications, medical care and services.6 This concept may seem impossible in the healthcare space due to the inherent complexity of the market, but ProspHire has developed an innovative approach for health plans.

ProspHire’s approach involves a partnership of artificial intelligence, behavioral science-based insights and marketing and health plan expertise to deliver a service of the following attributes:

- Rapid speed to value

- Artificial Intelligence calibrated by industry expertise

- Proven, personalized communication leading to member action

- Scalability through a user interface that coordinates multiple performance indicators across a variety of stakeholders

Turn-Key Solution for Improved Retention and CAHPS Scores

The competitive health insurance landscape is not a new phenomenon. As a result of this market pressure, most clients have one or many competitive resources, such as AI and machine learning, excellent product design or competitive marketing and sales groups. The reality of bringing all those resources to bear to deliver personalized marketing or product recommendation campaigns in a performance cycle is unlikely. This partnership provides a calibrated AI platform, project management support and tailored interventions with little disturbance to employees’ current duties and responsibilities. Selected interventions can be launched just a few weeks after project initiation.

This program is designed to be self-sustaining and operate adjacent to key business owners and IT professionals at the organization. Once the program is effectively running, it is transitioned back to business owners to manage long-term. There are six essential program components included in this service:

- Operations Assessment - Generate hypotheses regarding significant or unique barriers to current performance goals. Identify capacity gaps to address prior to A.I. pattern review.

- Data Request and Intake – Ensure general industry and unique drivers for poor retention or CAPHS scores are inserted into the AI Platform.

- Behavioral Science Analysis- Identify underlying human judgement and decision-making principles impacting the customer experience or interfering with engagement goals.

- AI Platform and User Interface- Calibrated with the assistance of healthcare professionals to identify actionable and meaningful patterns.

- Intervention Playbook – A prioritized list of interventions to address capacity gaps in operations, as well as important trends revealed by the AI analysis. Best industry practices and behavioral science approaches will be used to design the interventions.

- Program Management – Project support and guidance from initiation through intervention.

Realizing Value with a Team-based approach to AI and Customer Experience

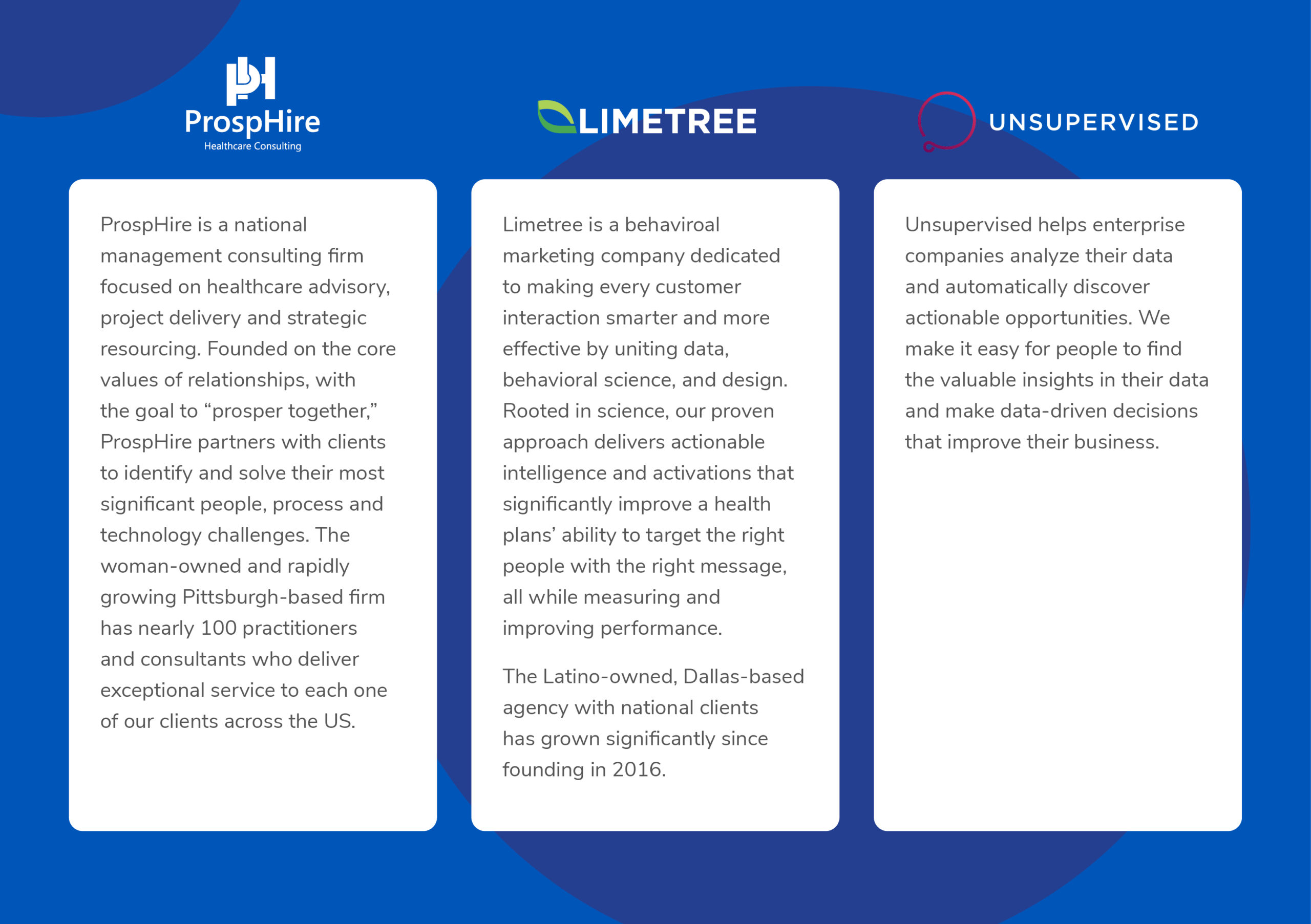

In industries outside of the health sector, 75% of business executives report prioritizing customer experience investment over the prior three years and the next three years.7 Health insurance companies may have a similar commitment, but the results today are not being realized at the level of these other industries. ProspHire, with the partners of Limetree and Unsupervised, can make a noticeable change in retention and CAHPS performance. This intervention not only delivers a quick win within a performance cycle but provides a long-term surveillance system to continually improve these areas. Once a client achieves and maintains the desired level of performance, the platform is easily scalable to other areas of customer experience or general operations. Some of these additional areas can be Stars quality measures, care/utilization management or connecting sales processes to member profiles.

Impact Retention Today

Do not let the current performance year pass before acting to improve key revenue driving metrics.

Works Cited

- Newsroom. Contract year 2021 Medicare Advantage and Part D Final Rule (CMS-4190-F1) Fact Sheet. CMS.gov. Published May 22, 2020. Accessed February 21, 2022. https://www.cms.gov/newsroom/fact-sheets/contract-year-2021-medicare-advantage-and-part-d-final-rule-cms-4190-f1-fact-sheet

- Carlton S, Malfara D, Neher K, Repasky. New Stars ratings for Medicare Advantage prioritize customer experiences. McKinsey & Company. Published October 15, 2020. Accessed February 22, 2022. https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/new-stars-ratings-for-medicare-advantage-prioritize-customer-experiences

- Phaneuf A. Use of AI in healthcare & medicine is booming – here’s how the medical field is benefiting from AI in 2022 and beyond. Business Insider. Published January 29, 2021. Accessed February 20, 2022. https://www.insiderintelligence.com/insights/artificial-intelligence-healthcare/

- 2020 CAQH Index – Closing the Gap: The Industry Continues to Improve, But Opportunities for Automation Remain. CAQH; 2021. Accessed February 20, 2022. https://www.caqh.org/sites/default/files/explorations/index/2020-caqh-index.pdf

- Cunningham S, McMillan M, O’Rourke S, Schweikert E. Cracking down on Government Fraud with Data. McKinsey & Company. Published October 15, 2018. Accessed February 22, 2022. https://www.mckinsey.com/industries/public-and-social-sector/our-insights/cracking-down-on-government-fraud-with-data-analytics

- Lagasse J. A quarter of Medicare Advantage subscribers changed providers in 2021, poll finds. Healthcare Finance. Published January 28,2021. Accessed February 21,2022. https://www.healthcarefinancenews.com/news/quarter-medicare-advantage-subscribers-changed-providers-2021-poll-finds

- Diebner R, Malfara D, Neher K, Thompson M, and Vancauwenberghe M. Prediction: the future of CX. Mckinsey & Company. Published February 24, 2021. Accessed February 22, 2022. https://www.healthcarefinancenews.com/news/quarter-medicare-advantage-subscribers-changed-providers-2021-poll-finds

© 2025 ProspHire, LLC. All Rights Reserved / Terms of Use / Privacy Policy