The 2025 Marketplace Rule: Challenges for Health Plans and Consumers

Let’s have a conversation

After the 2026 Final Letter to Issuers was published this January, Issuers likely felt relief that no major changes were in store for the upcoming QHP Certification cycle and 2026 Plan Year. Fast forward to today and the industry is scrambling to digest the 2025 Marketplace Integrity and Affordability Proposed Rule released on March 10th. The proposed rule introduces several changes that could impact ACA Marketplace enrollment and member subsidies.

Barriers to Continued Enrollment

Below are a few of the largest barriers to continued enrollment that members would face under the new Rule:

- Satisfying Debt for Past Due Premiums

- Today, Issuers are prohibited from taking a member’s current plan year premium and using it to satisfy a previously unpaid premium. In the proposed rule, this direction would be reversed and members could be forced to pay any outstanding debts on top of their new premium prior to receiving coverage.

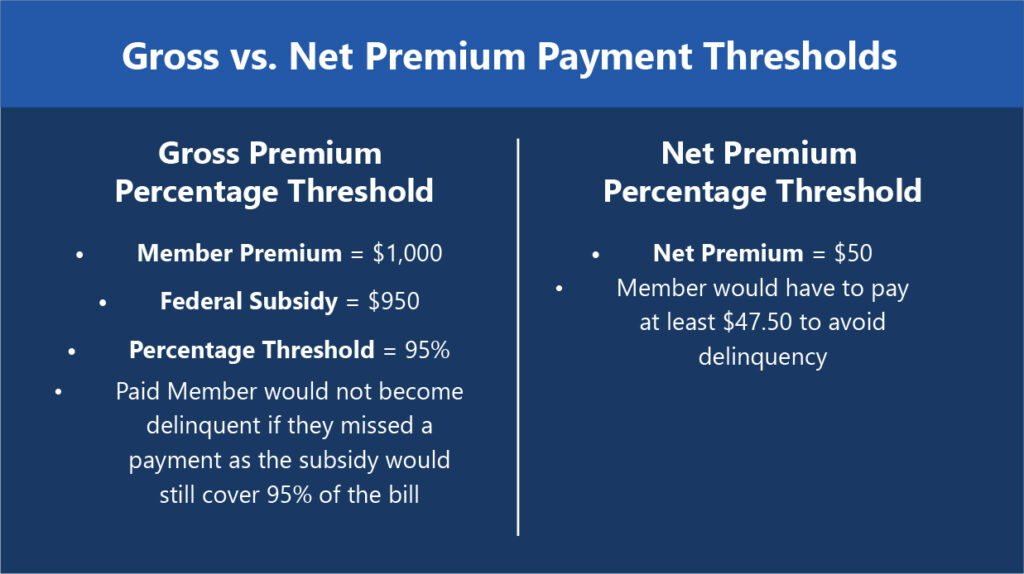

- Eliminating Gross Premium Percentage-Based and Fixed-Dollar Premium Payment Thresholds

- Health Plans are allowed to set their own payment thresholds prior to marking a member as “delinquent”. Plans have the autonomy to decide if this threshold is a percentage of the gross premium due (prior to subtracting any government subsidies), percentage of net premium or fixed dollar amount. Under this new rule, Plans would only be able to use a net premium percentage threshold.

- For Example:

- Gross Premium Percentage Threshold

- Member Premium = $1,000

- Federal Subsidy = $950

- Percentage Threshold = 95% Paid

- Member would not become delinquent if they missed a payment as the subsidy would still cover 95% of the bill

- Net Premium Percentage Threshold with same premium

- Net Premium = $50

- Member would have to pay at least $47.50 to avoid delinquency

- Gross Premium Percentage Threshold

- Shortening Annual Open Enrollment Period

- The new rule proposed shortening the annual open enrollment window by a full month, changing the last day to enroll from January 15th to December 15th.

- Subsidy Verification

- Several measures in the proposed rule aim to increase the difficulty for consumers to obtain and keep federal subsidies. Americans living below 400% Poverty Level currently depend on these subsidies to make ACA Marketplace coverage affordable. Under the new rule, these members would face a higher burden of proof for proving income as well as be required to continually respond to redetermination requests. Failure to comply would result in a reduction or loss in subsidies.

In addition to the barriers consumers will face, this new rule would also put a large administrative burden on Marketplaces and Issuers. Interested to hear how Health Plans will be responding to the request for comments on this Proposal.

How Can ProspHire Help?

At ProspHire, we specialize in navigating complex regulatory changes and optimizing health plan operations. Our team of experts can help your organization:

✅ Assess the Financial and Operational Impact – Understand how these rule changes will affect your enrollment, member retention and subsidy compliance.

✅ Develop Compliance Strategies – Ensure your health plan meets the new regulatory requirements while minimizing disruption to members.

✅ Optimize Member Engagement and Retention – Implement solutions that reduce member churn and improve payment processes under the new thresholds.

✅ Streamline Administrative Processes – Enhance efficiency in handling redeterminations, subsidy verifications, and enrollment period changes.

With our deep expertise in ACA Marketplace strategy, risk adjustment and quality performance, we’re here to help you stay ahead of the curve. Let’s connect to discuss how your health plan can proactively adapt to these changes.

© 2025 ProspHire, LLC. All Rights Reserved / Terms of Use / Privacy Policy